per capita tax burden by state

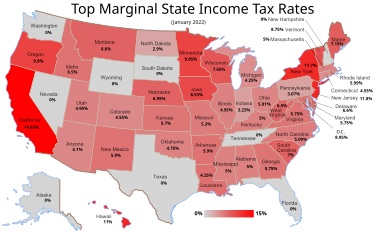

Walt Disney Worlds Magic Kingdom November 11 2001 in Orlando Florida. The jurisdictions with the lowest overall tax rate by state for the top earners are Nevada 19 Florida 23 and Alaska 25.

State Tax Levels In The United States Wikipedia

We share the overall tax burden by state for an average household to help decide where to move.

. 211 rows State tax levels indicate both the tax burden and the services a state can afford to provide residents. The statistic above provides information on the state and local tax burden per capita in the United States in fiscal year 2011. Surpass those in any state.

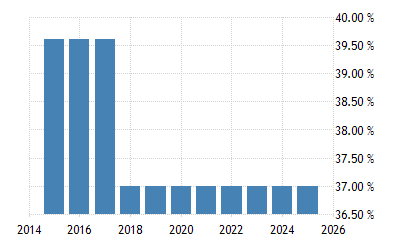

The state with the highest tax burden based on these three types of taxes is New York which has a total tax burden of 1228. States use a different combination of sales income excise taxes and user. The five states with the highest tax.

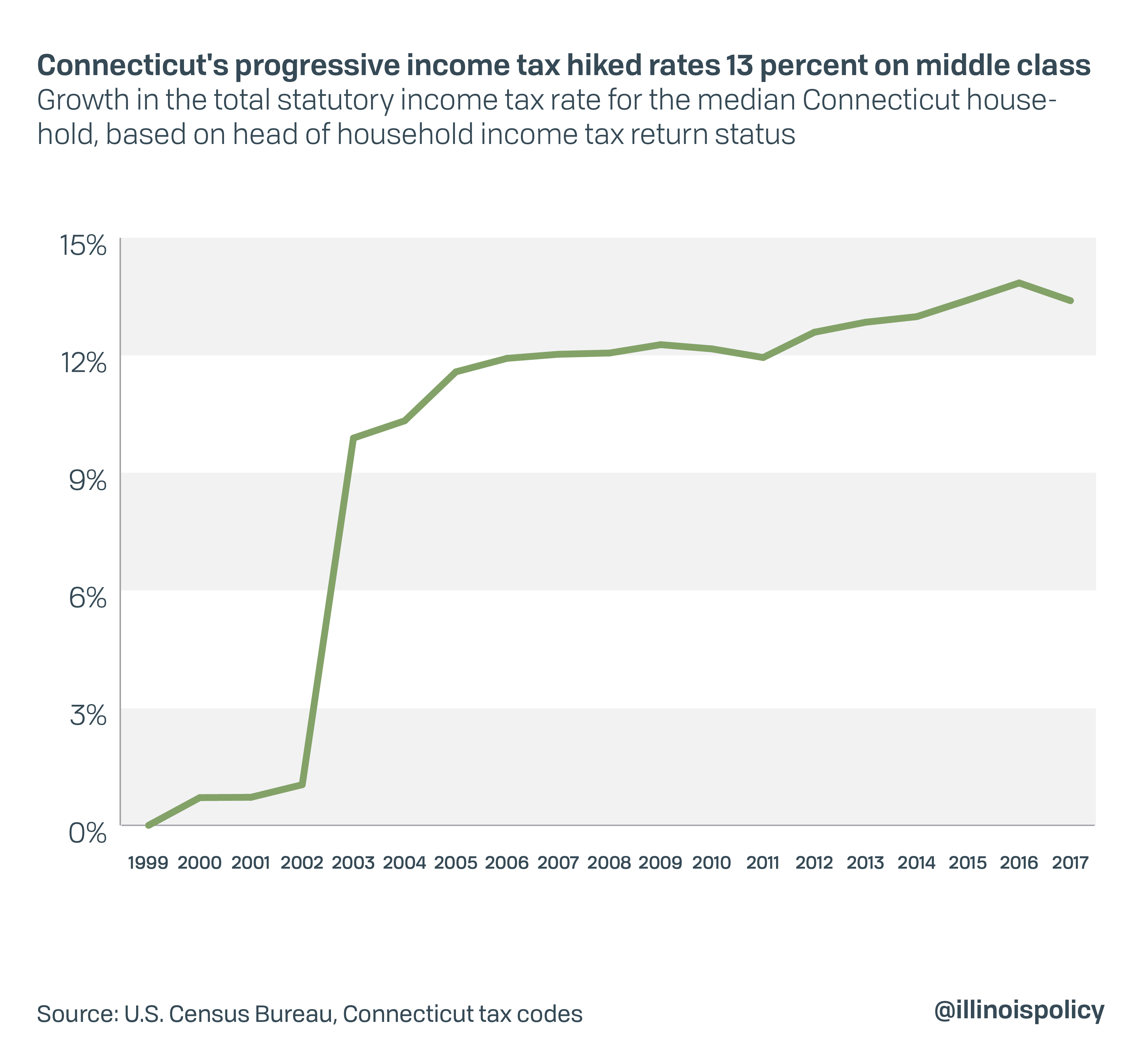

Our ranking of Best And Worst States for Taxes captures the total tax burden per capita not only for income property and sales tax but also. However residents of each of the top 10 states pay 3-5 times as much in federal. Finally New York Illinois and Connecticut.

The amount of federal taxes paid minus federal. State and Local Issues. Total taxes per capita.

The five states with the highest tax collections per capita are New York 9073 Connecticut 7638. The lowest state and local sales tax collections per capita are found in Alaska 335 Vermont 660 Virginia 651 West Virginia 753 Maryland 781 and South. And as the article said if you divide that by the number of people in Vermont you get a per capita tax burden of 4650.

In the fiscal year of 2011 the total tax burden. State and Local General Expenditures Per Capita. 3 Calculated based on State Local Sales Tax Rates as of January 1 2020.

DC is however a dramatic exception because it is entirely made up of a thriving urban center. Tax Burden State By State. Tax collections of 10717 per capita in DC.

Total taxes per capita.

Wallethub Tax Foundation Confirm What Illinoisans Already Know They Re Overtaxed Wirepoints Wirepoints

Tax Burden Per Capita Other State Austin Chamber Of Commerce

Impacts Of Tax Structure At The State Level Summary Crowe Uw Madison

How Connecticut S Tax On The Rich Ended In Middle Class Tax Hikes Lost Jobs And More Poverty Illinois Policy

State Local Tax Burden Rankings Tax Foundation

Mapped Visualizing Unequal State Tax Burdens Across America

At 1 436 Washington Ranks 24th In Property Taxes Per Capita Again State And Local Tax Burden Ranks Near Middle Opportunity Washington

Monday Map State Tax Collections Per Capita Tax Foundation

State Local Tax Burden Rankings Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Tennessee State And Local Tax Burden 80 Of Missouri S United For Missouri

State And Local General Expenditures Per Capita Tax Policy Center

State Tax Levels In The United States Wikipedia

Raising State Income Tax Rates At The Top A Sensible Way To Fund Key Investments Center On Budget And Policy Priorities

Wallethub Tax Foundation Confirm What Illinoisans Already Know They Re Overtaxed Wirepoints Wirepoints